The Best Guide To IRS Provides Update on Status of Processing Returns and

A Biased View of Take advantage of the Employee Retention tax credit - Estes

It is also rumored that the IRS may be processing 2020 payroll refunds prior to 2021 payroll refunds. To inspect any new IRS status postings, visit: and scroll down to "Filed a Tax Return". Formerly it was expected that after the amended payroll reports have actually been submitted, the internal revenue service would release refunds within 6 weeks to 6 months.

How to Apply for the Employee Retention Credit and get a Refund for Your Business - Wegner CPAs

To inspect the status of your refund, you can call the IRS at (877) 777-4778. Anticipate extended wait times. We recommend that the very best strategy is to go to the internal revenue service website. Sadly, Reference don't anticipate there to be any new or extra info gained from a call conversation.

A simplified approach to the Employee Retention Tax Credit (ERTC)

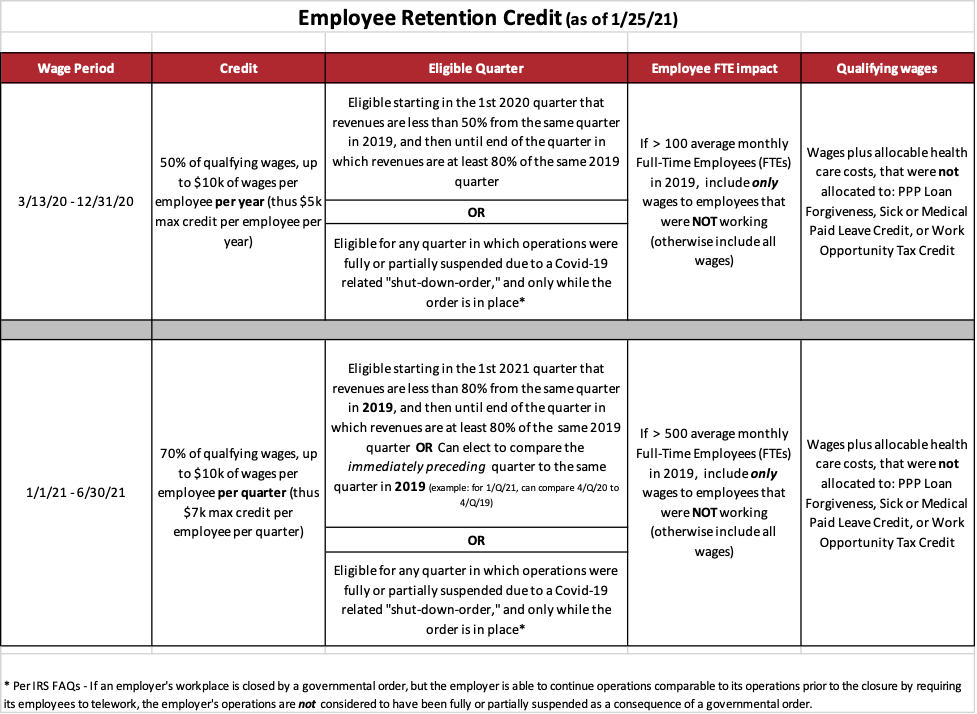

The Consolidated Appropriations Act of 2021 signed into law on December 27, 2020 broadened both which employers are qualified for Staff member Retention Tax Credit (ERTC) in 2020 however it also extended ERTC into the very first two quarters of 2021. The ERTC is a refundable payroll tax credit that was first introduced by the CARES Act in March 2020.

Facts About Employee Retention Credit (ERC) - AICPA Revealed

If the amount of credit surpasses the employment tax deposits, the employer can use for an advance payment of the credit on internal revenue service Kind 7200 as long as Kind 7200 is submitted by the filing due date of Form 941 for the particular quarter. The American Rescue Strategy Act of 2021 signed into law on March 11, 2021 extended ERTC for the rest of 2021.

IRS Issues Some Employee Retention Credit Exclusions

Available to earnings paid in between March 13, 2020, and December 31, 2020 Offered to organization owners that employ less than 100 workers. The employees of all associated business with common ownership should be dealt with as a single employer for purposes of figuring out if there are 100 or more employees. Can access ERTC if the company owner had operations that were fully or partially suspended due to COVID-19 or experienced a significant decline in gross income of at least 50% in gross revenue in one quarter of 2020 compared to that very same quarter in 2019 Equal to 50% of earnings paid to each worker approximately a maximum of $10,000 per staff member per year.